south dakota sales tax on vehicles

South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. With local taxes the total sales tax rate is between 4500 and 7500.

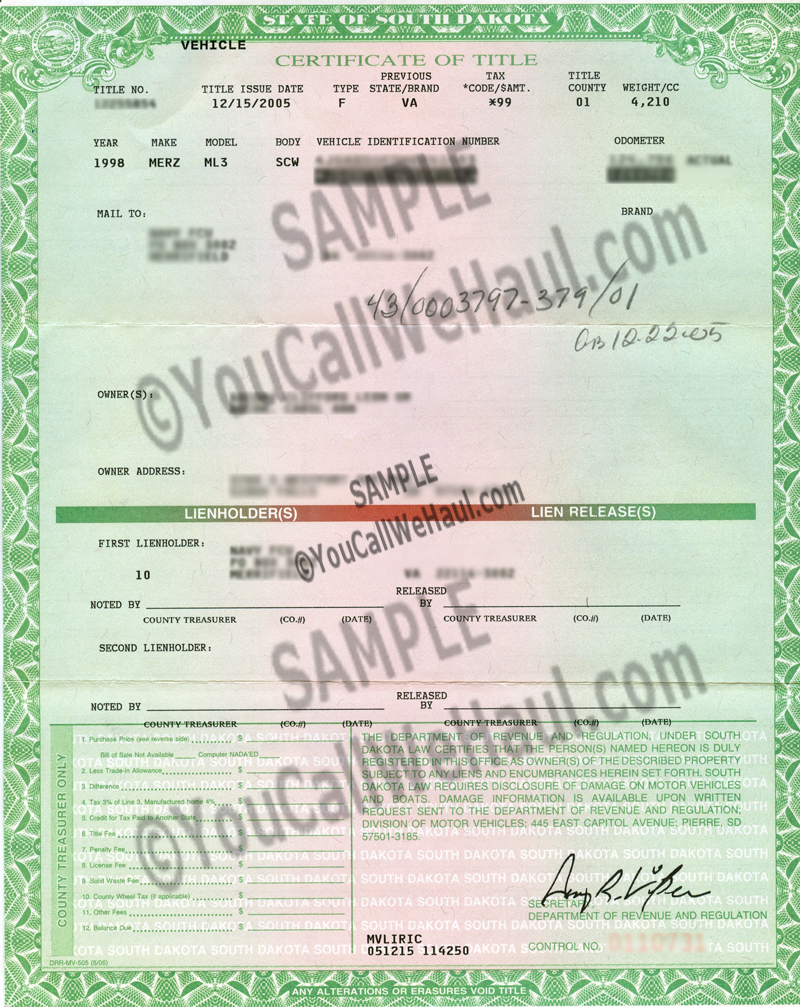

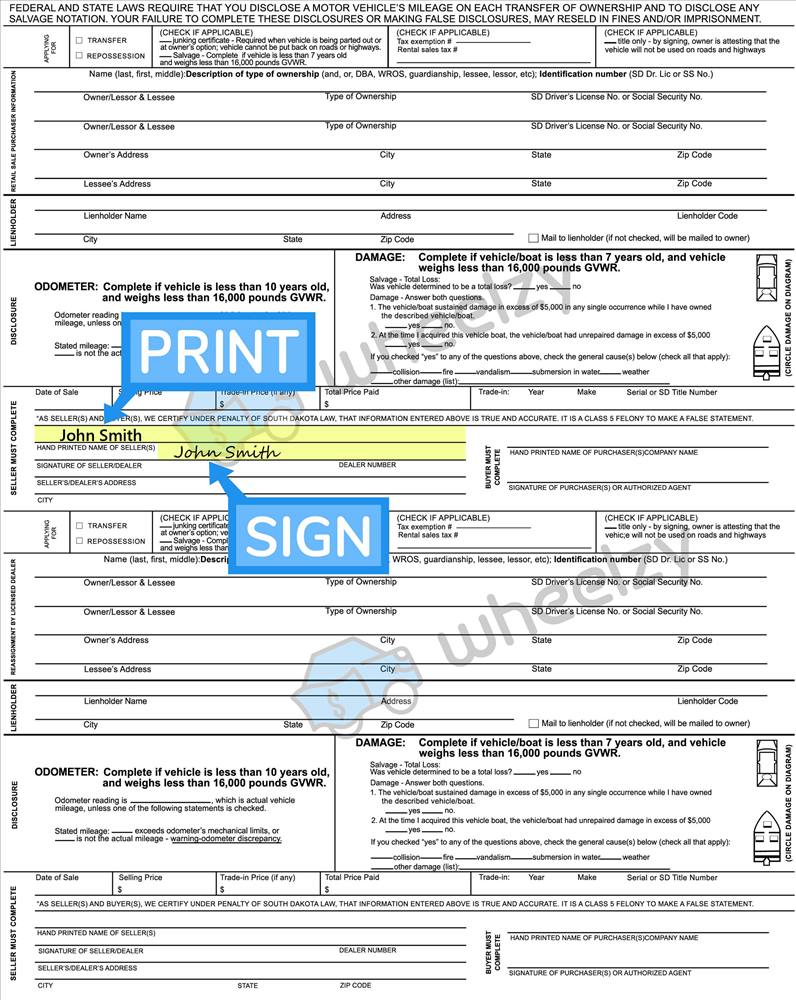

How To Transfer South Dakota Title And Instructions For Filling Out Your Title

What Rates may Municipalities Impose.

. In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees. Processing Fee For Renewals 29 For Up To Five Vehicles. The use tax rate is the same as the sales tax rate.

Motor Vehicles TAXABLE In the state of South Dakota any rentals which last for less than twenty eight days will be subject to an additional vehicle rentals tax. You pay the states excise tax 4 of the vehicles purchase price only when registering a vehicle for the first time after a recent purchasechange of ownership. See Sales Tax Guide.

The purchase of prescription medication and gasoline are tax-exempt. South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax. The use tax is due on the purchase price including freight and handling charges.

21500 for a 20000 purchase Roslyn SD 75 sales tax in Day County 20900 for a 20000 purchase Pine Ridge SD 45 sales tax in Shannon County. 19 For Each Additional Vehicle More Than Five. The state sales and use tax rate is 45.

Can I import a vehicle into South Dakota for the lone purpose of repair or modification. Previously subjected to sales tax use tax motor vehicle excise tax or similar tax by this or any other state or its political subdivision is not subject to the tax levied by this chapter if the applicant applies for registration of the motor. SDCL 32-3 Title Registration Liens and Transfers.

Ad Lookup Sales Tax Rates For Free. Traditional Goods or Services Goods that are subject to sales tax in South Dakota include physical property like furniture home appliances and motor vehicles. There are a total of 193 local tax jurisdictions across the state collecting an average local tax of 1125.

Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. South Dakota state and municipal use tax applies to all products and services when the applicable sales tax is not collected. You can find these fees further down on the page.

Tangible Media Property TAXABLE. Select the South Dakota city from the list of popular cities below to see its current sales tax rate. For vehicles that are being rented or leased see see taxation of leases and rentals.

The South Dakota sales tax and use tax rates are 45. Repealed by SL 1990 ch 230 7. Its what is known as an open registration state.

South Dakota has recent rate changes Thu Jul 01 2021. All car sales in South Dakota are subject to the 4 statewide sales tax. However the buyer will have to pay taxes on the car as if its total cost is 12000.

Different areas have varying additional sales taxes as well. What is the tax rate for SD. SDCL 32-1 State Administration of Motor Vehicles.

Use tax is due in the filing period in which the product or service is received. The South Dakota sales tax and use tax rates are 45. The purchaser is responsible for contacting their County Treasurer to pay the motor vehicle excise tax and to title and license the vehicle within 30 days of their purchase.

SDCL 32-3A Title Registration and Taxation of Boats. Sales Tax of 4 Is Due Only If You Have Not Paid Sales Tax Previously. Print a sellers permit.

Certain trailers are also. South Dakota Codified Laws 32-5B-21 32-5B-21. What is South Dakotas Sales Tax Rate.

Purchasers of most new and used motor vehicles trailers semitrailers and motorcycles owe a 4 motor vehicle excise tax on the purchase price. 31 rows South Dakota SD Sales Tax Rates by City The state sales tax rate in South Dakota is 4500. Click here for a larger sales tax map or here for a sales tax table.

This is the case even when the buyers out-of-pocket cost for the purchase is 10800. That means you dont have to be a state resident to register your vehicle. South Dakota has a motor vehicle excise tax fee of 4 percent of the purchase price.

Report the sale of a vehicle. It should be noted that any leases or rentals maintained for greater than twenty-eight days are considered to be exempt. Municipalities may impose a general municipal sales tax rate of up to 2.

For example here is how much you would pay inclusive of sales tax on a 20000 purchase in the cities with the highest and lowest sales taxes in South Dakota. SDCL 32-4 Theft and Misappropriation and. The highest sales tax is in Roslyn with a combined tax rate of 75 and the lowest rate is in Buffalo and Shannon Counties with a combined rate of 45.

All brand-new vehicles are charged a 4 excise tax in the state of South. Get Started Laws Regulations. If You Paid 3 Sales Tax South Dakota Will Charge You 1 Sales Tax.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to South Dakota local counties cities and special taxation districts. South Dakota laws and regulations regarding vehicle ownership. For additional information on sales tax please refer to our Sales Tax Guide PDF.

The South Dakota Department of Revenue administers these taxes. Do you have to live in South Dakota to register a Car. Additionally South Dakota has a motor vehicle gross receipts tax of 45 percent that applies to the rental of cars trucks motorcycles and vans if the business rents them to the same person for less than 28 days.

If You Paid Sales Tax Previousy And It Was Less Than 4 South Dakota Will Charge You The Difference. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. Yes you can but you wont be allowed to operate it in South Dakota under any circumstances.

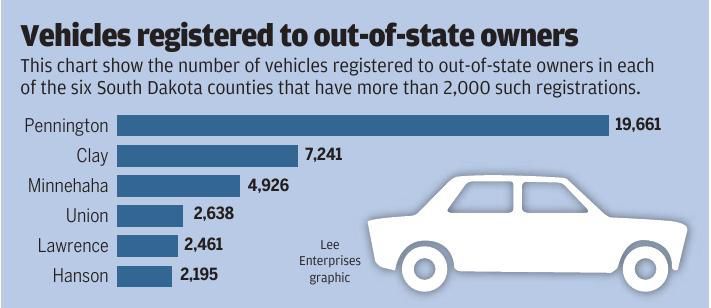

South Dakota has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 6. Interactive Tax Map Unlimited Use. When it comes to vehicle licensing South Dakota is special.

South Dakota is unique in the fact that almost all services are taxable.

What S The Car Sales Tax In Each State Find The Best Car Price

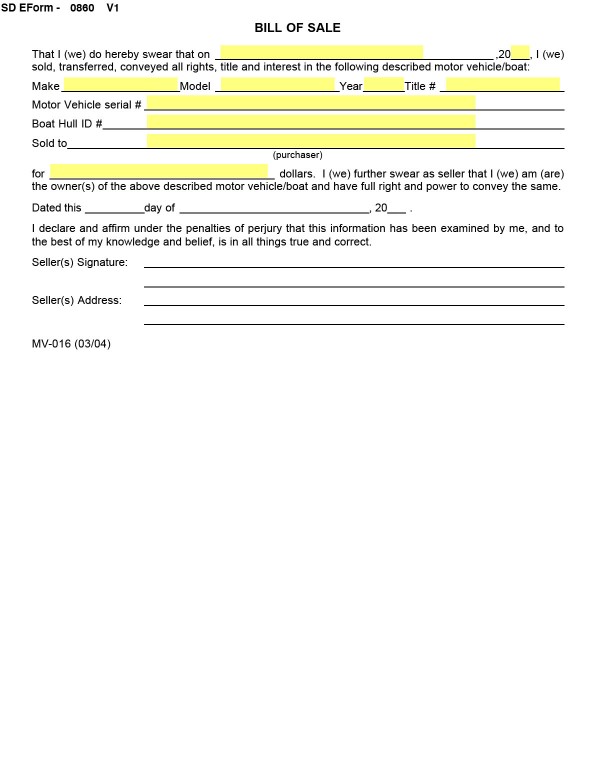

Bills Of Sale In South Dakota The Forms And Facts You Need

Lakota Country Times Oglala Lakota County Gets Police Vehicles Native American News Native American Indians Country Time

South Dakota Vehicle Title Donation Questions

Free South Dakota Vehicle Bill Of Sale Form Pdf Formspal

Great Plains Streetrodders Sd License Plate Information

58 334 Out Of State Vehicles Registered In South Dakota Local Rapidcityjournal Com

South Dakota Vehicle Registration Vehicle Registration Services Dakotapost

Vehicle Registration Service No Emissions Or Inspections Dirt Legal

Sales Tax On Cars And Vehicles In South Dakota

Motor Fuel South Dakota Department Of Revenue

How To Sign Your Car Title In South Dakota Including Dmv Title Sample Picture

Car Sales Tax In South Dakota Getjerry Com

South Dakota License Plates Discover Baja Travel Club

Pin On Jerry S Chevrolet Of Beresford

5 Common Errors When Titling A Vehicle South Dakota Department Of Revenue

Vehicle Registration Service No Emissions Or Inspections Dirt Legal

What You Need When Selling Your Vehicle To A Private Party South Dakota Department Of Revenue